The following is a summary of the changes that have come into effect:

- Customs Declarations are required between Great Britain and the European Union, therefore Commercial or Pro-Forma Invoices are needed.

- The EU-UK Trade and Cooperation Agreement means that in most cases Customs duties will not be applied as a zero tariff has been confirmed for goods sent between GB and the EU, however this is conditional on Rules of Origin Requirements being confirmed when shipping.

Note that VAT will still be levied.

- Changes to UK VAT requirements have been implemented.

EUROPEAN UNION (EU) IMPORT CUSTOMS GUIDELINES

The information in this document is guidance to help ensure goods being sent from Great Britain to European Union countries clear Customs as quickly as possible.

COMMERCIAL / PRO-FORMA INVOICE

The Commercial or Pro-Forma Invoice is an essential document to ensure efficient customs clearance. Please find below an overview of the key elements, with more detailed examples in the following pages:

- Goods Descriptions: line item descriptions of the commodities (using precise & plain language) included on the invoice.

Please also ensure clear descriptions are on the Waybill.

- Harmonised System (HS) Code & Country of Origin: line item HS Code (commodity code) and Country of Origin of the goods.

- Values & Currency: line item breakdown of the applicable cost elements (e.g. line item value of goods, freight, insurance, packaging, etc.), and sum-up of Total Invoice Value with the currency in which the transaction occurred.

- Weight / Unit & Quantity: indicate the gross/net weight, unit (e.g. KG) and quantity (e.g. 2 items) on line item level.

- Incoterm & Place: include the INCOTERM® & place (as required under the applicable term).

- Proof of Origin Statement: if applicable, include the Proof of Origin statement on the Invoice to qualify for preferential customs duty rates.

- EORI Number: if applicable, indicate a valid EORI number. The EORI number of the receiver/Importer must be indicated on the invoice for all B2B shipments.

- VAT Number: if applicable, indicate the VAT identification number in the Invoice. Note: for private individuals (B2C), if required due to country legislation, please indicate the personal tax ID or social security number on the invoice to avoid the need for the receiver to be contacted before a shipment can be cleared (as this can lead to delays).

- Shipper/Exporter & Receiver/Importer: indicate full name, full address (street, number, city, country, postal code) & contact details (phone number/e-mail) NOTE: if the Receiver of Goods and Importer of Record are two different entities, please ensure to include the full details of both parties. If they are the same, just indicate once.

- Reason for Export: please indicate the reason for export, e.g.: permanent, repair & return, temporary, gifts.

- Invoice Number: please indicate an invoice number.

In addition to a complete & accurate Commercial / Pro-forma invoice, it’s essential that you verify if any other Government requirements apply for your goods, e.g. Veterinary & Phytosanitary laws.

Below, you will find more detailed information/guidance for the key elements required on the Commercial/Pro-Forma Invoice, along with other requirements.

IMPORTANT: this a non-exhaustive document, only covering the key elements to facilitate the import clearance into the European Union. The importer/exporter must ensure its own research/assessment is completed on the regulatory requirements for their goods.

A) GOODS DESCRIPTION

- Please ensure a complete & accurate goods description is included on both the Commercial Invoice & Waybill (on the Commercial Invoice, indicate descriptions on line item level for each of the commodities being shipped).

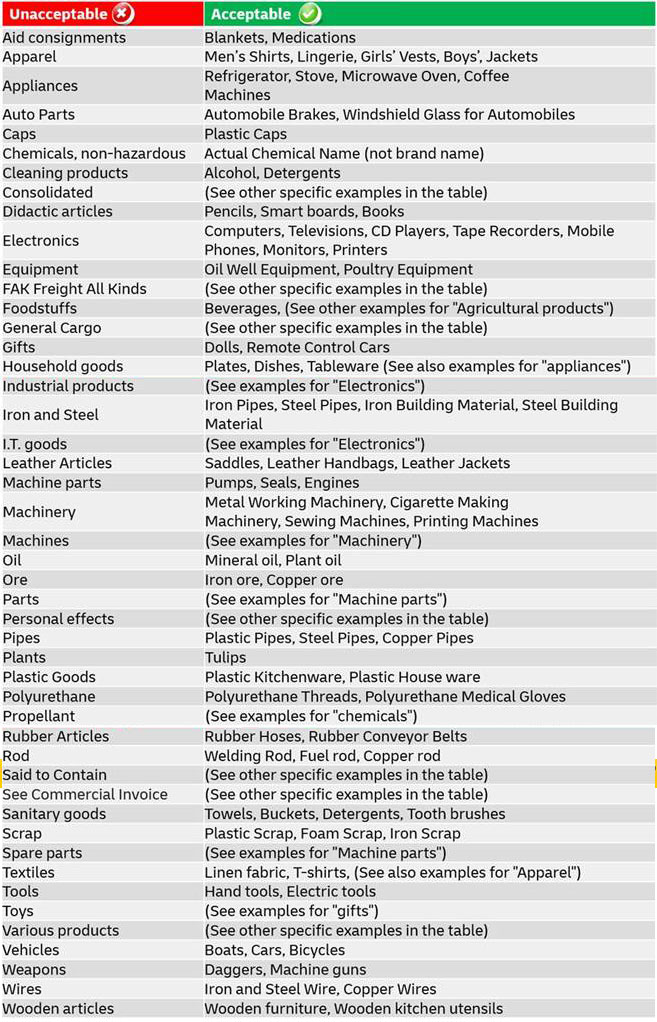

- Acceptable Goods Descriptions include complete information, providing sufficient detail about the precise nature of goods in plain language. It should indicate what the goods are, for which purpose the goods are used and what they are made of.

- This enables Customs Authorities to identify prohibited/restricted goods as well as perform adequate risk profiling for safety and security reasons.

Examples:

NOTE: The European Commission has published a document with examples of unacceptable/acceptable waybill goods and commercial invoice descriptions.